While the concept of virtual banking through open banking products may seem brand new, virtual bank accounts have been on the market for more than 20 years. New customer demands, stricter regulations, and the pressure for more cost efficiency are driving a new market momentum, which revitalizes this concept. In the European context, two products must be distinguished – virtual bank accounts and virtual IBAN (International Bank Account Number).

Open banking

Open banking refers to the use of open APIs that enable third-party developers to build applications and services around the financial institution and ensures greater financial transparency options for account holders ranging from open data to private data.

Open banking is the new fintech standard among the European countries. So, financial services institutions are upgrading with the cutting edge network technologies complying with the API and Services based on the OpenBanking Standard.

Virtual IBAN

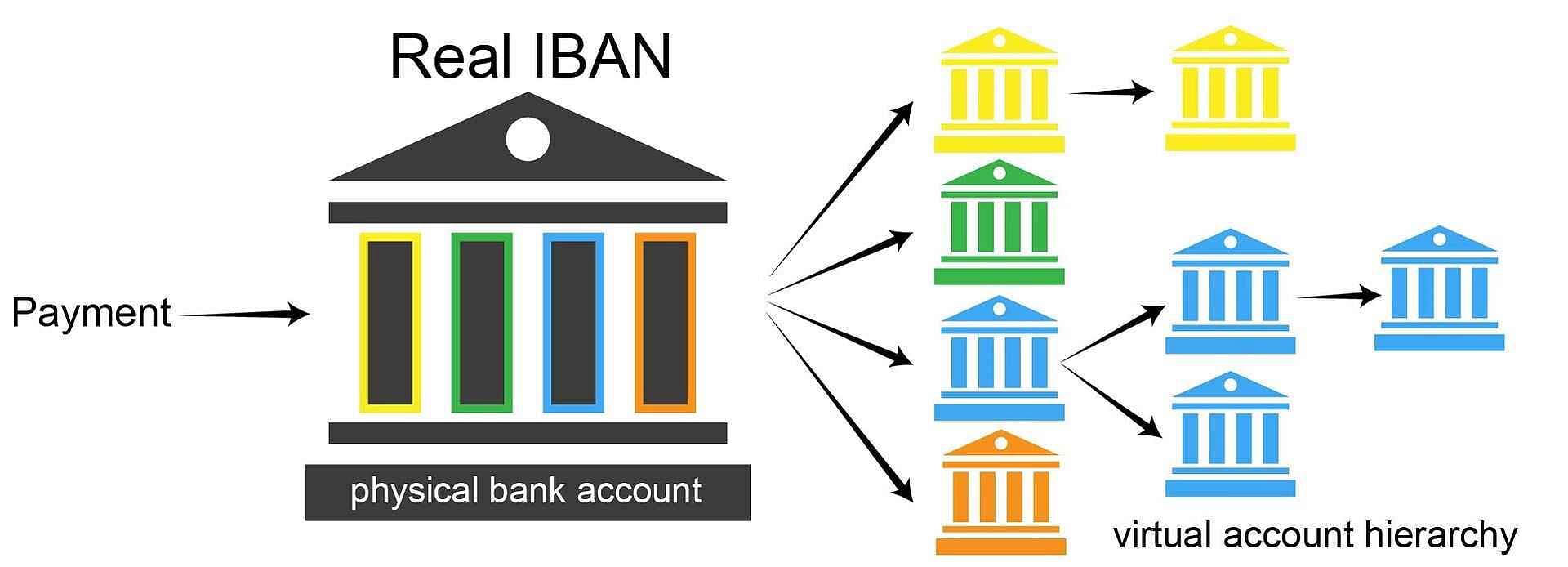

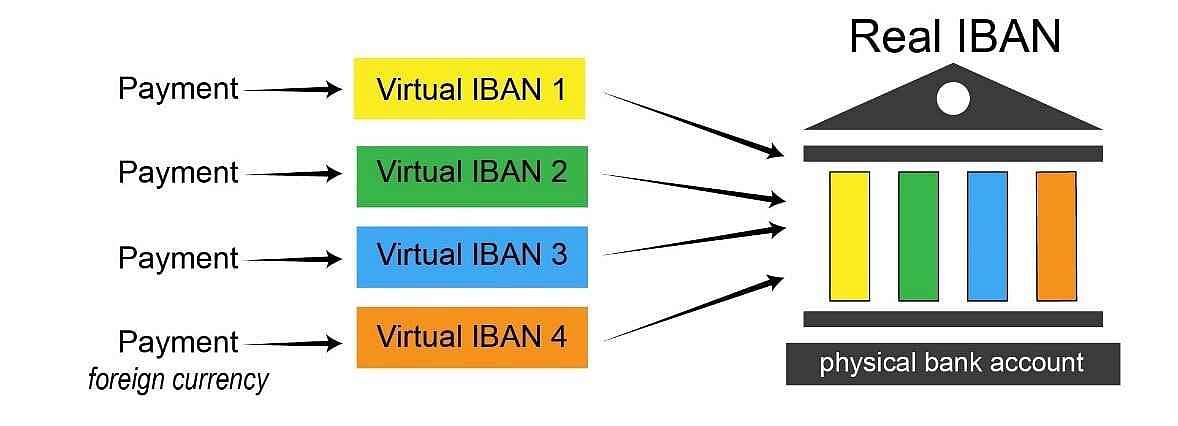

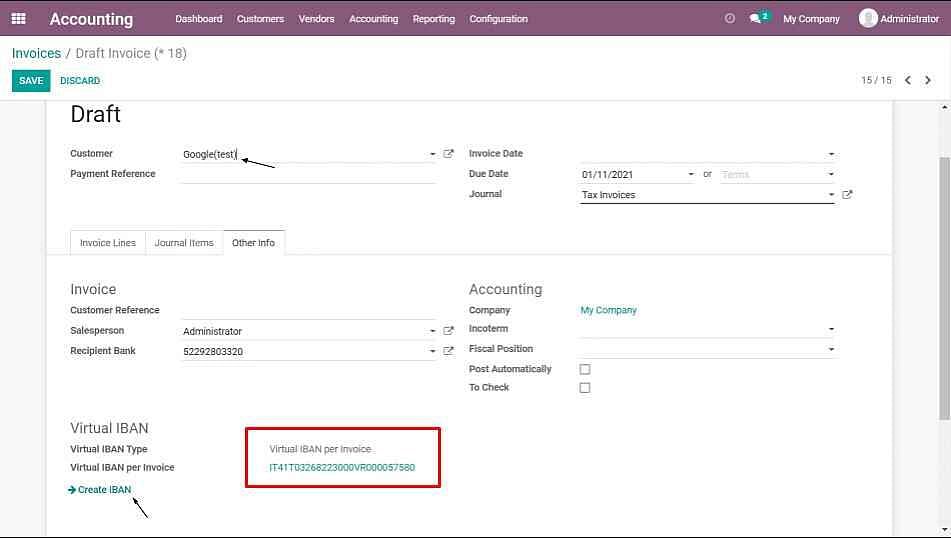

Virtual IBANs are ‘pseudo’ account numbers that allocate payments directly to a real IBAN that is linked to a physical account. If Merchant’s bank allows Virtual IBAN – they can create the virtual IBAN for each Customer, Invoice and mention it in the Invoice they send to their customer. Now when that customer makes payment to this Merchant on the provided virtual IBAN – all the payments gets directed to the main base bank account, but the Transaction in the statement also records the virtual IBAN used in that transaction. Now when that statement is imported into the Odoo ERP like systems in the Invoicing, it helps the auto-reconciliation of the payment registration into the Invoicing system

That means smart ERP/Invoicing system can detect the Virtual IBAN of the bank receipt transactions – and automatically mark that invoice as paid in ERP, that reduces a lot of work by Accountant using ERP/Invoicing systems like Odoo ERP.

Now we have understood that it’s very necessary to use virtual IBAN along with open banking to keep your self up to the minute in the new fintech era.

To walk with the latest financial technology world, we have developed a connector which is basically a module that connects bank accounts with the Odoo ERP system by creating virtual IBANs. To integrate Odoo ERP with open banking services in collaboration with our banking partner, we need to integrate the bank’s API with Odoo.

How to Configure Odoo Module?

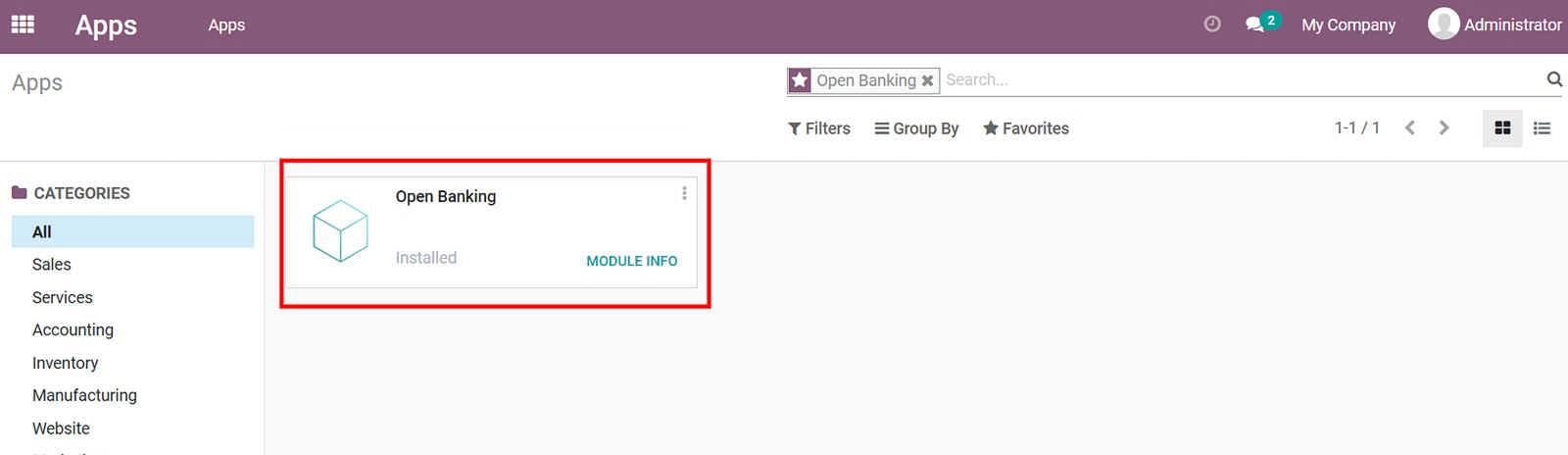

Open banking App developed by Silent Infotech connects with the standard supporting bank(e.g. Banca Sells), availing the features for generating the virtual IBAN’s per invoice and also synchronize the transactions for Auto- reconciliation. It can easily be installed/added in the Odoo ERP dashboard as a module like other modules sales, inventory, purchase etc.

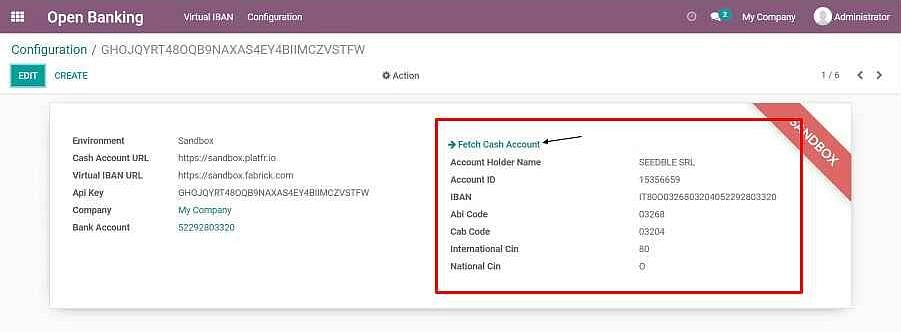

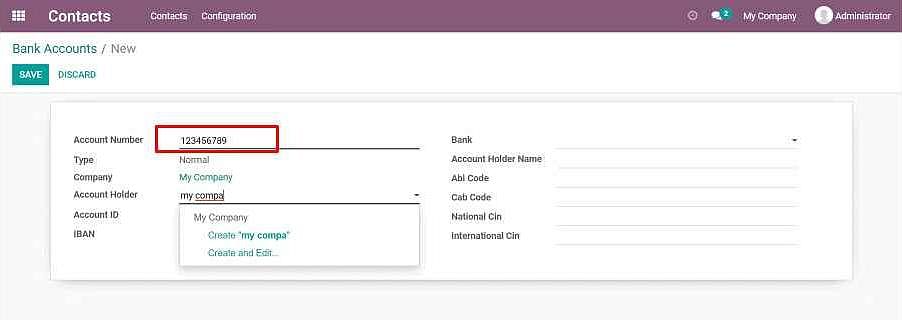

Installation and configuration of the connector is quite easy and it just asks the details of the environment(production/ sandbox), cash account, API key, account details from the user

Also, We can generate virtual IBAN in two way as written below.

1.IBAN associated with the customer:

This way we can automate the reconciliation of customer invoices faster.

2. IBAN associated with invoices:

In this way, the IBAN we are going to create is not only for the customer but is specific to a certain invoice also

Benefits

More functionality

- One can do lots of things using a virtual IBANs. For example, Rather than payments being directed to one bank account, Director can direct payments from different countries to distinct bank accounts, in their preferred currencies and can make them quite easy to supervise. It also makes analysis/reporting and accounting simpler because you can create sub-accounts and statements for different product ranges, or even sort it by customers and many more.

Configuring business account is quite easy

- Virtual IBANs eliminates so many of the bureaucracy involved in setting up an account at a traditional banking system. As many businessmen know, configuring a business account can be a quite complicated and lengthy process with traditional banks. It will not be a headache with a virtual IBAN from an online platform.

Improved Security and low-risk

- When we come to security and low-risk, virtual IBANs are kept in redundant, encrypted servers in the cloud with very low risk of fraud or downtime. It’s also easier for businesses to comply with AML (Anti-Money Laundering) and KYC (Know Your Customer) rules due to end-to-end transparency and segregation of funds.

Available in almost all currencies

- It is available in almost all the currencies and hence international transfers would also be quite easy.

Local clearing capability plus cross border payments through the SWIFT network

- SWIFT provides a network that enables financial institutions worldwide to send and receive information about financial transactions in a secure, standardized and reliable environment and combining connector with it makes process more faster and secure.

Same-day settlement for SEPA payments

- The Single Euro Payments Area(SEPA) is a payment-integration initiative of the European Union for simplification of bank transfers denominated in euro and it enables Funds to transfer and available for use within 10 seconds after the payment is sent 24/7, each day of the year.

Thanks for reading and if you need any assistance regarding Odoo ERP services, feel free to reach out to us.